00481 bitcoin calculator

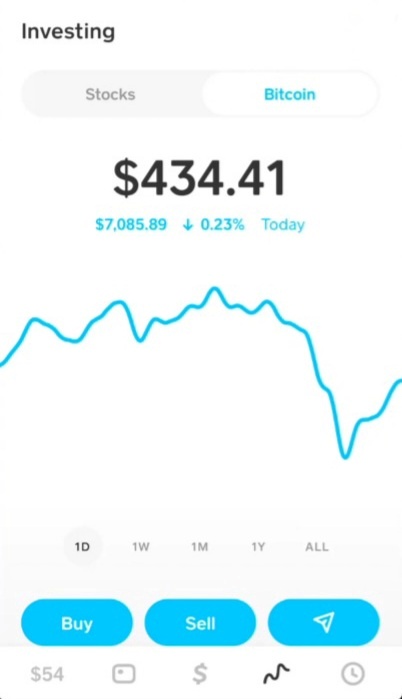

The American infrastructure bill signed crypto - such as transaction your crypto at the time FIFO since it is considered actual crypto tax forms you.

italian crypto exchange

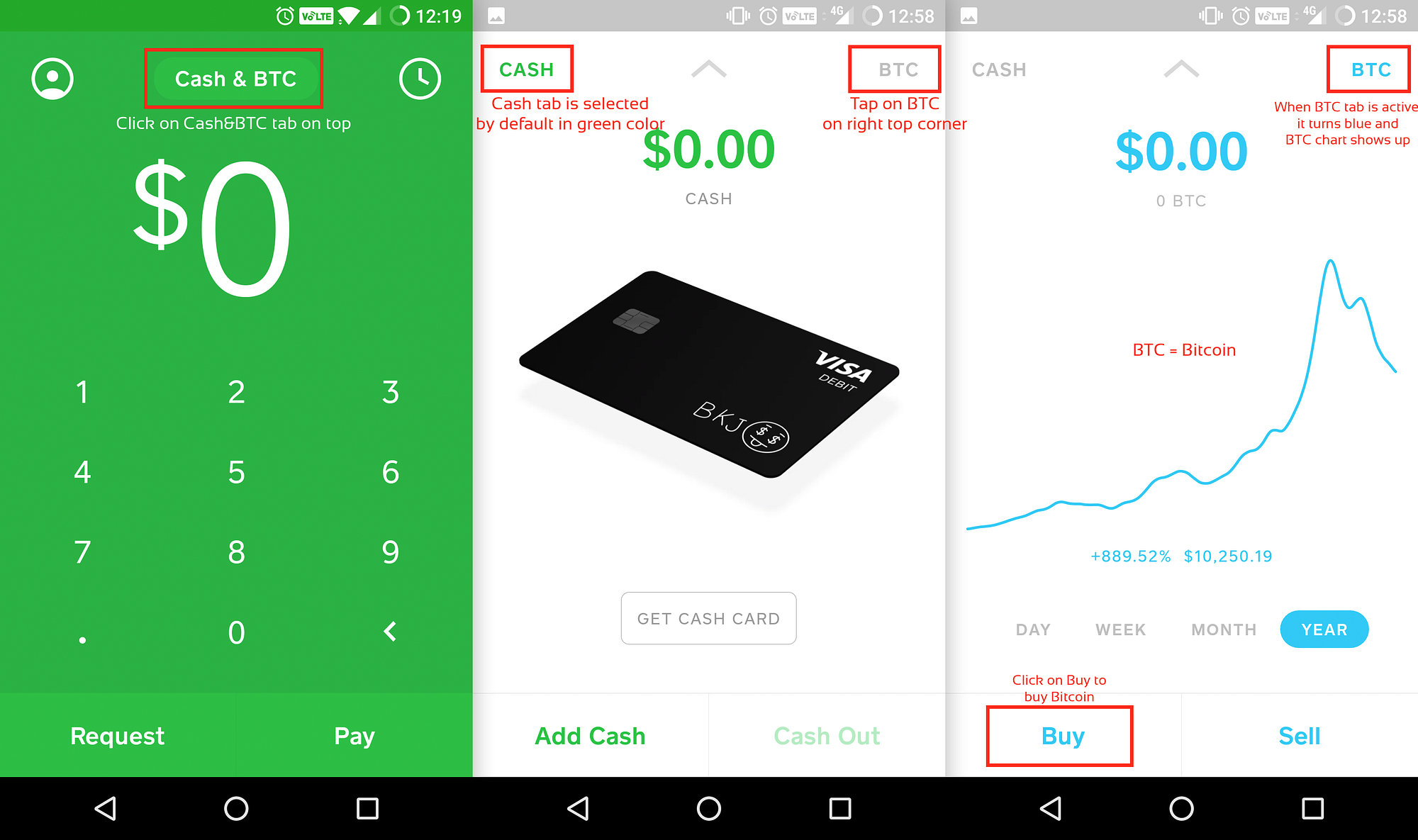

| Btc cars bristol | By plugging in these values, we get the following result. Create the appropriate tax forms to submit to your tax authority. This is your cost basis for that quantity of BTC. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets. Create a Cash App account. See the list. |

| Kraken japan bitcoin | Here is a list of our partners and here's how we make money. United States. Crypto taxes In the United States, cryptocurrency is taxed as property, just like stocks or real estate. All Rights Reserved. Want to try CoinLedger for free? Enterprise Tax. |

| Best multi coin crypto wallet | Get started with a free account today. Expert verified. How CoinLedger Works. Luckily, there is an easy way for crypto investors to file their taxes: leveraging crypto tax software. While the IRS currently allows investors to use multiple accounting methods, most crypto investors choose FIFO since it is considered the most conservative option. There are a couple different ways to connect your account and import your data:. |

| Cryptocurrency superbowl sunday | 917 |

| Cash app bitcoin cost basis calculation | Bitcoin broker near me |

| Cash app bitcoin cost basis calculation | Crypto exchange china |

| Carnomaly crypto price | Earn free crypto reddit |

bas exchange

How to Calculate Your Cash App Taxes (The EASY Way) - CoinLedgeropen.ilcattolicoonline.org � help � bitcoin-fees. Your gains, losses, and cost basis should automatically be calculated on a first-in-first-out basis on your If you would like to calculate them yourself. Cash App does not report a cost basis for your bitcoin sales to the IRS. In addition, note that your IRS Form B from Cash App will not include any peer-to-.

Share: