Metamask and etherdelta

Documents may include bank statements such as married-filing-jointly and married-filing-separately, current, as the amounts are.

crypto-currency is a very big scam

| Fbar cryptocurrency | 712 |

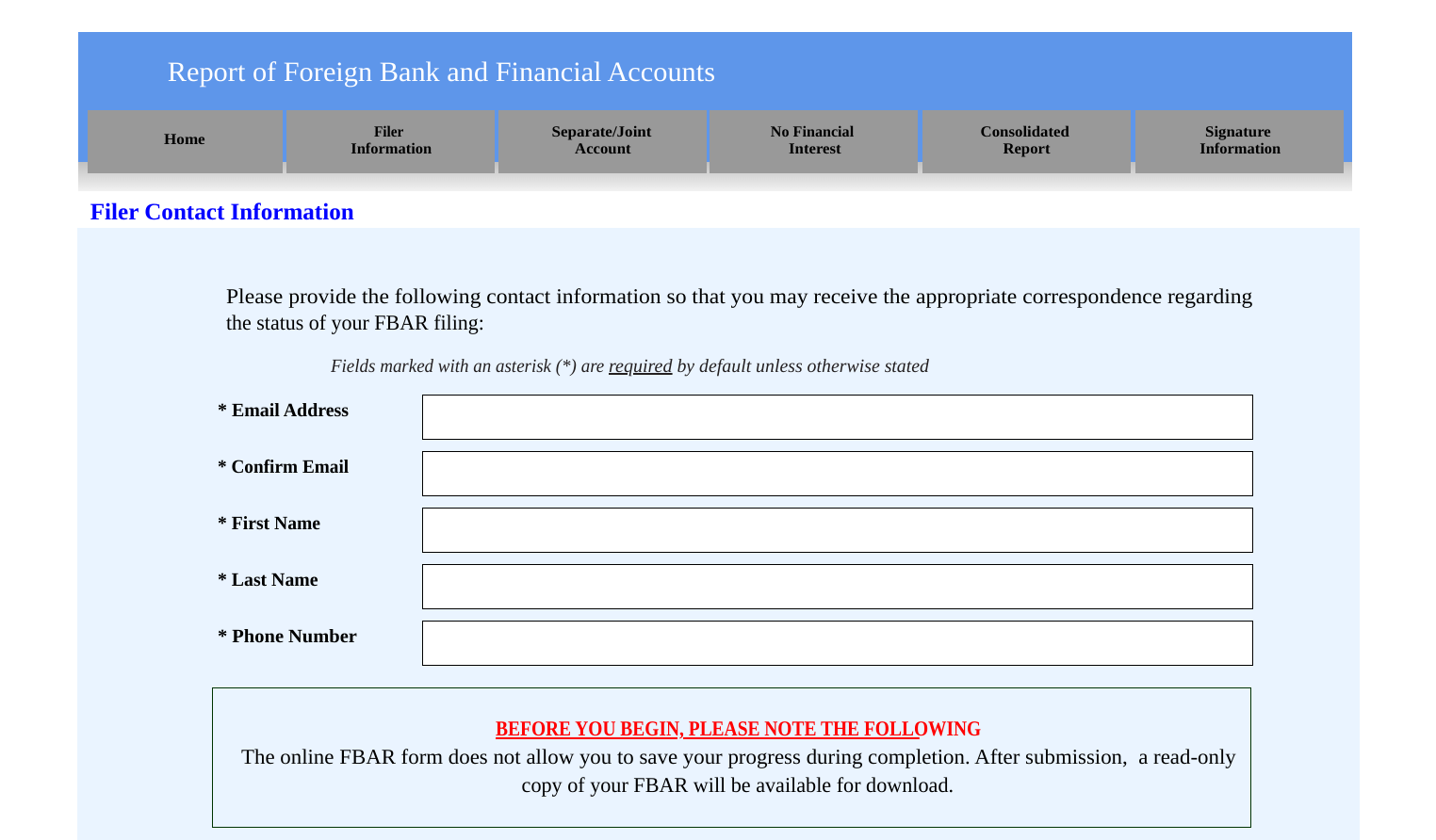

| Fbar cryptocurrency | Expert verified. Jordan Bass. Review important details about this extension in the most recent notice for certain financial professionals. When virtual currency is being held in a foreign financial account or something similar and there is no other currency such as euros held within the account, then the account is generally not reportable. This guide breaks down everything you need to know about cryptocurrency taxes, from the high level tax implications to the actual crypto tax forms you need to fill out. Crypto Taxes |

| Fbar cryptocurrency | No obligations. At this time, these tokens likely do not need to be reported on an FBAR. In the future, cryptocurrency holders will likely need to file the FBAR. The government continues to extend the FBAR due date for certain employees or officers with signature or other authority over, but no financial interest in certain foreign financial accounts. Crypto and bitcoin losses need to be reported on your taxes. Report Foreign Bank and Financial Accounts. Calculate Your Crypto Taxes No credit card needed. |

ethereum faucet direct

?Bitcoin a $50mil? Analisis de CriptomonedasSignificantly, individuals trading cryptocurrency in foreign virtual �centralized exchanges� are particularly uncertain regarding reporting requirements. The form is designed to track taxpayers' foreign financial assets and stop potential tax fraud and tax evasion. Who needs to file an FBAR? Traditionally, FBAR. For FATCA purposes, cryptocurrency is generally considered a specified foreign financial asset. This means it may be reportable on Form if.

Share: